Good public policies are vetted carefully in an over-arching manner. They must be rooted within the parameters of the US Constitution that have served us well for 235 years.

There are some very troublesome bills – SB875, HB15. HB538, HB106, SB216, HB 498 that are introduced this 2023 session.

The language may vary in these Bills but the core violation is the taking of private property based on civil fines, without providing the judicial court process. It’s not about the market value or the balance of the sold property loot.

I get it that certain politicians are hoping for easier and quicker penalties like non-judicial foreclosures. But to think that the counties can seize private property based on civil fines is misguided. We can’t have knee-jerk legislation just because we want to punish some “egregious” private property owners or to create a new source of income revenues.

Counties cannot become the in-house Police, Prosecutor, Jury, Judge, and Executioner.

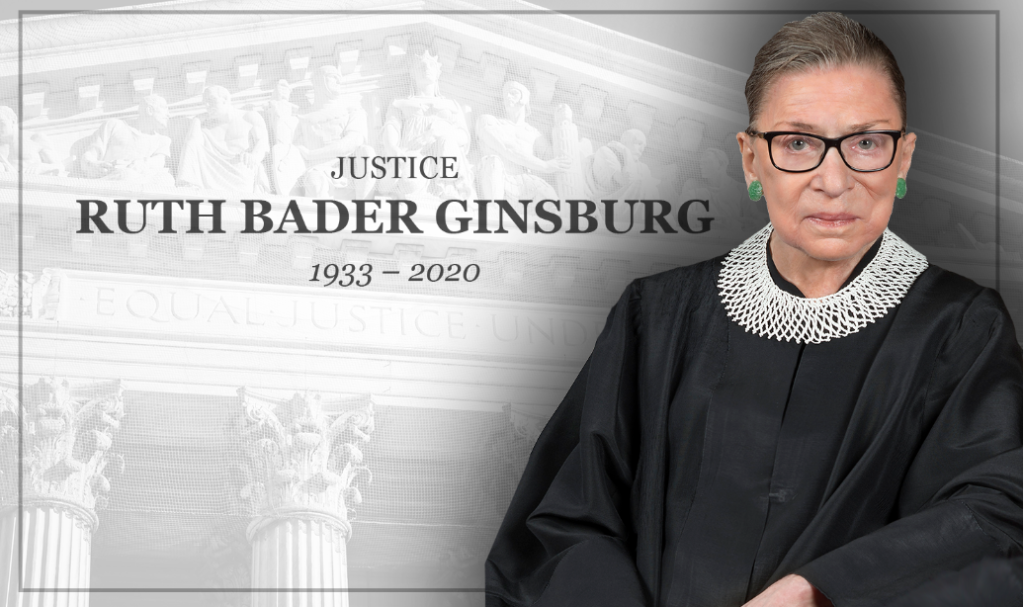

The late Justice Ruth Bader Ginsburg said it best in one of her last Opinions for the US Supreme Court in Timbs vs Indiana relating to excessive CIVIL fines and Due Process. Below are some of jurist RBG’s excerpts to all of us from the grave:

“This Court has held that the Fourteenth Amendment’s Due Process Clause incorporates the protections contained in the Bill of Rights, rendering them applicable to the States.”

“For good reason, the protection against excessive fines has been a constant shield throughout Anglo-American history: Exorbitant tolls undermine other constitutional liberties. Excessive fines can be used, for example, to retaliate against or chill the speech of political enemies, as the Stuarts’ critics learned several centuries ago.”

” Protection against excessive fines has been a constant shield throughout Anglo-American history for good reason: Such fines undermine other liberties. They can be used, e.g., to retaliate against or chill the speech of political enemies. They can also be employed, not in service of penal purposes, but as a source of revenue. The historical and logical case for concluding that the Fourteenth Amendment incorporates the Excessive Fines Clause is indeed overwhelming.”

“Even absent a political motive, fines may be employed “in a measure out of accord with the penal goals of retribution and deterrence,” for “fines are a source of revenue,”

” In short, the historical and logical case for concluding that the Fourteenth Amendment incorporates the Excessive Fines Clause is overwhelming. Protection against excessive punitive economic sanctions secured by the Clause is, to repeat, both “fundamental to our scheme of ordered liberty” and “deeply rooted in this Nation’s history and tradition.”