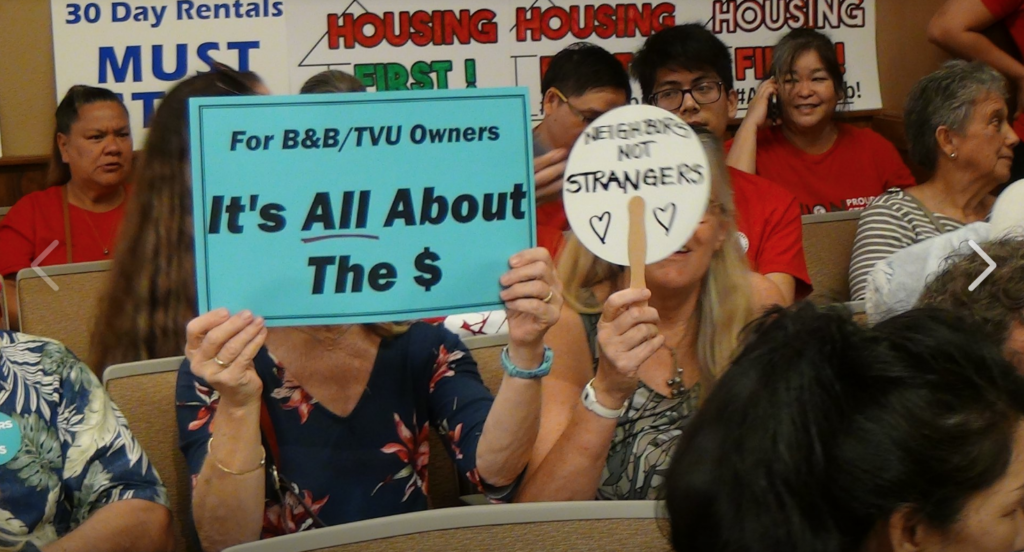

The City and County of Honolulu City Council adopted Bill 89 and Bill 85 on June 17, 2019 after many long and contentious hearings.

Honolulu Mayor Kirk Caldwell signed Bill 89 into law on June 25, 2019. On July 3, the City Council chose not to address Bill 85 Veto.

Here is the information provided by the Department of Planning and Permitting:

June 21, 2019

City Department of Planning and Permitting

New Regulations on Short-Term Rentals

Bill 89 CD2 was adopted by City Council on Monday, June 17. It is awaiting action by Mayor Kirk Caldwell. Its main points:

_Allows a limited number of new Bed and Breakfast Homes (B&B) in non-resort areas under a new registration process, with annual renewal required.

_Continues to prohibit Transient Vacation Units, or “unhosted” rentals, in non-resort areas, unless the dwelling has a Nonconforming Use Certificate (NUC).

_Regulates hosting platforms, such as Expedia or Airbnb, requiring monthly reports to be filed with the Department of Planning and Permitting, which will share the information with City Council.

_Makes illegal any form of advertising short-term rentals which are not in compliance with zoning regulations as provided in Bill 89. Bill 89 CD2: http://bit.ly/2Kt9Qu9

The following Questions and Answers are based on the assumption that Bill 89 CD2 will shortly be enacted into law.

ADVERTISING

I own an unhosted, “whole house,” or Transient Vacation Unit. I pay taxes. Can I continue to advertise online and in the local newspaper?

Only if the dwelling has a NUC or is located in a resort district.

When will the department start enforcing the new advertising restrictions?

Beginning August 1, 2019.

What are the fines for illegal advertising?

Owners of the property involved in illegal advertising will be notified, and if the advertisement is taken down in 7 days, no fine will be imposed for a first offense. If not taken down within this deadline, fines of between $1,000 and $10,000 can be imposed for each day the advertisement remains on display.

If the management company for my property places an illegal ad, will the company get cited?

They may be cited, but Bill 89 CD2 says, “The burden of proof is on the owner of the subject real property to establish that the property is not being used as a bed and breakfast home or transient vacation unit or that the advertisement was placed without the property owner’s knowledge or consent.”

REGISTRATION OF NEW BED AND BREAKFAST HOMES

I have been operating a Bed and Breakfast Home for several years. Do I still have to obtain a registration number?

Yes, unless you have a NUC.

I only rent out my house for more than 30 days at a time. Do I need to register?

No.

I only rent my house while my family spends 2 weeks each year visiting family on the mainland. Do I need to register? When can I register?

Registration will begin no sooner than October 1, 2020.

Why do we have to wait more than year to register?

The time is required for the Department to develop more specific procedures for implementing Bill 89 CD2, including the adoption of rules, and creating the software to help with enforcement and the registration process. If necessary, it provides time to acquire more staff and to train them.

What are the registration requirements?

There are more than a dozen requirements. Most notable:

_Applicants must be “natural persons,” and not an organization or company

_Applicants must have a home exemption granted under real property tax law

_There must be insurance coverage for bed and breakfast use

_The initial registration fee is $1,000. For annual renewals, the fee is $2,000

_No more than 2 bedrooms can be used for visitor accommodations

_Quiet hours must be observed between 10 pm and 8 am

_If part of a homeowners or apartment owners association, approval by that association must be obtained

_Neighbors within 250 feet must be given a phone number to contact to make complaints 24 hours a day

For the complete list of requirements, refer to Bill 89 CD2: http://bit.ly/2Kt9Qu9 3

Are there other requirements?

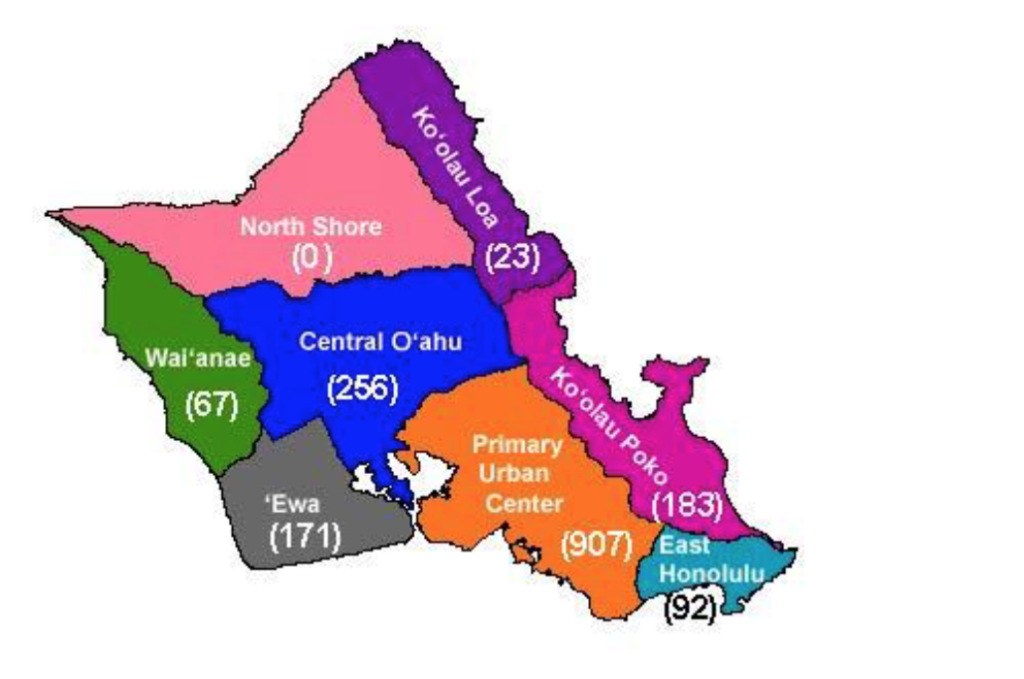

Density Limit. No more than 0.5% of the total number of dwelling units in each regional development plan area (DPA) can be used as B&Bs. Here are the limits by area:

New B&Bs are not allowed in the North Shore area, based on directives of the North Shore Sustainable Communities Plan: http://bit.ly/2Y4QpLg

Condominium Limit. Up to 50% of units in a condominium building may be allowed a B&B, subject to AOAO approval.

Nontransferable. Registration numbers are not transferable to another property, nor transferable to another homeowner.

Separation Minimum. B&Bs must be at least 1,000 feet from each other. This does not apply to units in resort areas and NUCs.

Renewal Criteria. Noise and other nuisance complaints can be grounds to deny renewal requests.

For the complete list of requirements, refer to Bill 89 CD2: http://bit.ly/2Kt9Qu9

How long will it take to get registered?

It is not yet determined. An online registration process is anticipated, but certain requirements will have to be verified; e.g. compliance with parking requirements.

If only a limited number of registration numbers will be given out, how can I guarantee to get one?

There is no provision for guarantees.

How will it be determined who gets a registration number?

Generally on first-come, first-served basis. If the number of requests exceeds the limit for a DPA, then a lottery will be held.

How will the lottery system work?

This will be fleshed out in the Rules. There will be a public hearing on the draft Rules before they are finalized.

I am currently operating a B&B, and do not have a NUC, so will need to register. Will I get priority in the registration process?

No.

Can I advertise and operate a short-term rental once I register?

No. To avoid a citation, operation cannot occur until the registration process has been completed and registration number issued.

MORE INFORMATION

Note that DPP has not mentioned about the property tax designation to “Resort”. It’s unclear whether it would be based only on the two bedrooms of a home.

Refer to the Department’s website:honoluludpp.org

Email the Department:info@honoluludpp.org

Call the Department:

Advertising Restrictions: 768-8127

Registration Process: 768-8127

General Zoning Information: 768-8252

Make a complaint: 768-8127

Public Information Officer: 768-8284

Choon James has been a real estate broker for over 30 years. She can be reached at 808 293 8888 ChoonJamesHawaii@gmail.com

Daniel James has been a Real Estate Associate for 5 years. He can be reached at 808 542- 5165 http://www.HawaiiRealEstateOhana.com